Learning how to cut a pineapple is very simple, and once you do it, you will get fresh pineapples all the time. Don’t miss all my recipes at the bottom of the post that use fresh pineapple.

I really love recipes that use fresh pineapple. But it wasn’t until I was pregnant with my oldest that I learned how to cut a pineapple. I started craving it like mad and was eating at least one pineapple a week by myself!

My very favorite way to eat a pineapple is to cut it into spears and make grilled pineapple – it makes the most delicious light dessert! Though I am constantly coming up with new recipes that use this delicious fresh fruit. I’m sure that I will get you hooked as well!

Below you will find a step-by-step guide to cutting up pineapple with photos to walk you through it. I have no doubt that once you do it a few times you will be a pro.

How to Tell if a Pineapple is Ripe

Before we dive into how to cut a pineapple, let’s talk about what you are looking for when you are picking out a fresh pineapple at the store.

- Look at the color. You want to pick a pineapple that is more yellow on the eyes than green. The more yellow, the more ripe.

- Lightly press on it. Pick up the pineapple and feel it. It should have a very slight give. If it has no give, it is underripe and you should pick a different one. On the other hand, if it is soft, it is over-ripe and you don’t want that either.

- Smell the bottom. It should smell fruity and sweet.

Skip Under Ripe Pineapples

Pineapples don’t ripen that much after they are picked. For that reason, look for peak ripeness at the grocery. Additionally, if you are waiting for the one on the counter to ripen, you are probably just risking it going bad.

How to Cut Up a Pineapple

Step 1: Remove the Ends

Place the pineapple on a cutting board and using a large sharp knife, cut off both the top and the bottom. Be sure to remove enough of both ends, that you are left with almost a cylinder. It is okay if it comes a little at the top and bottom, but step two will be easier if you are left with a cylindrical shape.

Step 2: Cut off the Skin

Now, make small slices off the sides, removing the skin. You want the cuts to be deep enough that you take off the eyes, but not so deep that you take off a lot of the meat of the pineapple.

Step 3: Quarter the Pineapple

After removing all of the skin, you want to cut the pineapple into quarters. To do this, first cut it in half and then cut each half in half again to create four pieces.

Step 4: Cut out the Core

There is a thick core in the middle of every pineapple that is perfectly edible, but not particularly appetizing. It is very easy to remove. Just cut down the front of each quarter like you are cutting off the top of a pyramid.

Step 5: Cut the Pineapple into Spears

I typically cut each quarter (that has the core removed) into three or four pieces. From there you can keep them as spears for grilling, or cut them into smaller bite sized pieces for snacking. If you are making a recipe like my Pineapple Salsa, it may work better to cut each spear into thin strips and then dice those.

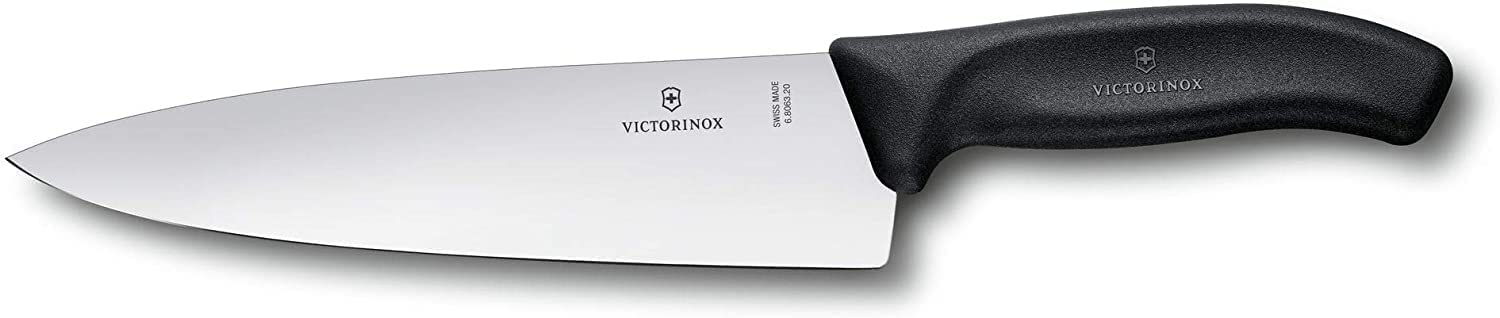

What Knife to Use

I like to use a large chef’s knife to cut up a pineapple. It works great to both cut through the whole pineapple and shave off the skin. I wouldn’t particularly recommend the knife you see in the photos. It has since been replaced with the knife you see below. This is a knife I have now had for years, and I absolutely love it.

Chef's Knife

How Long Will Cut Pineapple Last

After cutting, store your pineapple in an airtight container. Eat within three to four days. Or make something delicious out of it!

Great Recipes Using Fresh Pineapple

- Grilled Pineapple – This is a great summer dessert, but I even like to make it on the indoor grill top in the winter.

- Simple Fruit Salad – such an easy side dish that you will love so much!

- Pineapple Mango Salsa – this is one of my favorite salsa recipes, it is delicious and easy!

Cat says

Lisa… the knife in the pictures you’re using to cut the pineapple looks like a ceramic knife. Yet the one on Amazon is not. No?

I actually discuss this in the post.